Bitcoin (BTC) is currently trading slightly higher, hovering around $64,000 on Thursday, after facing resistance at the $64,700 upper consolidation level the previous day. The price has been consolidating between $62,000 and $64,700 for the past week. Recent insights from QCP Capital highlight how macroeconomic developments are fostering a favorable environment for Bitcoin's growth.

Bitcoin Optimism Grows Amid Supportive Global Macroeconomic Developments

According to QCP Capital's report, the People's Bank of China (PBoC) has implemented several policies aimed at revitalizing its struggling housing and equity markets. These measures appear to have had a positive impact, with Chinese A50 futures closing 8% higher. Furthermore, the PBoC unveiled a 500 billion RMB swap facility for non-bank financial institutions, a move that could further stimulate the market.

With the recent interest rate cut by the US Federal Reserve, analysts anticipate additional easing measures from central banks globally. This liquidity injection is expected to benefit risk assets, including cryptocurrencies like Bitcoin.

Additionally, the widening yield spread between 2-year and 10-year US Treasury notes indicates growing optimism about economic recovery, which traditionally supports risk assets in the medium to long term.

On the political front, Kamala Harris has expressed strong support for AI and digital assets, leading to a positive market reaction among related cryptocurrencies. Moreover, the SEC's approval of options trading on BlackRock’s Spot BTC ETF signifies increasing institutional interest in digital assets.

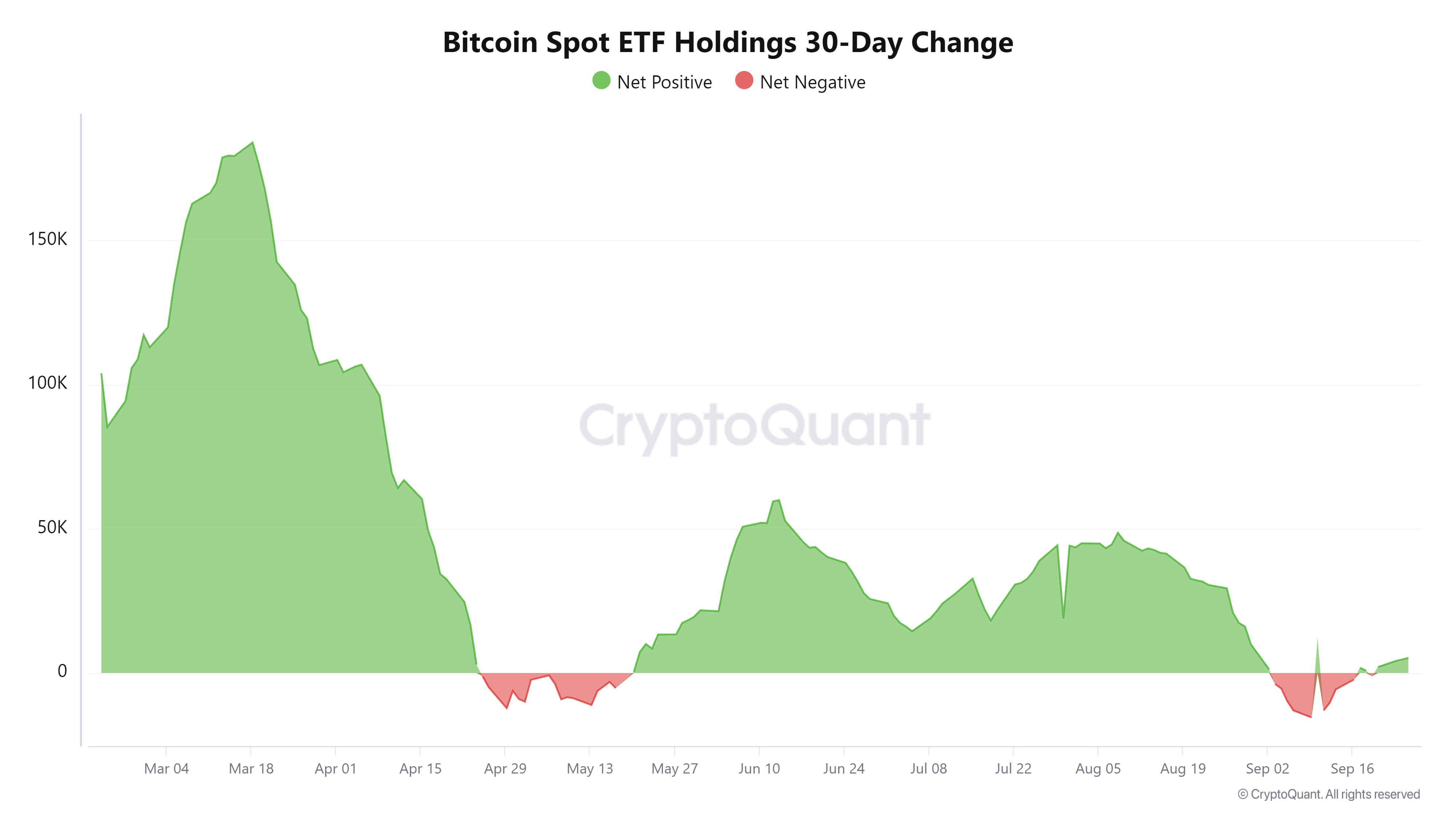

Ki Young Ju, CEO of CryptoQuant, noted a significant rise in the US's dominance in Bitcoin holdings, driven by increasing demand for spot ETFs. This trend suggests a potential rally in Bitcoin's price, reflecting growing confidence among investors.

However, not all signals are positive. Arkham’s intelligence data indicates that the MT. Gox wallet is beginning to move funds, which could lead to market volatility. After receiving $370,000 in BTC from Kraken, the wallet emptied four of its wallets, potentially signaling upcoming repayments to creditors. This situation may create fear, uncertainty, and doubt (FUD) among traders, as creditors might sell their BTC holdings on centralized exchanges.

Technical Analysis: BTC Extends Consolidation Between $62,000 and $64,700

Bitcoin's price has been trapped in a consolidation phase between $62,000 and $64,700 for over a week, following a 7.5% rally last week. It faced rejection from the $64,700 level for the third time. Currently, it trades slightly above $64,000.

If Bitcoin breaks above this range, it could target the $65,379 resistance level, with a daily close above that potentially leading to a surge towards the $70,079 high from July 29. The Relative Strength Index (RSI) currently indicates bullish momentum, although caution is advised if it approaches overbought territory.

Conversely, a drop below $62,000 could see Bitcoin decline by 7%, retesting its September 17 low of $57,610.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!