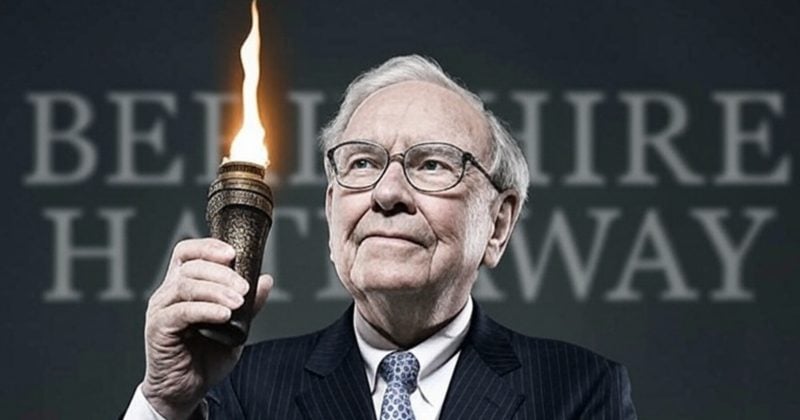

Warren Buffett Steps Down as CEO

Warren Buffett, the legendary investor, has announced that he will step down as CEO of Berkshire Hathaway by the end of the year, with Greg Abel set to take over leadership. Under Buffett's stewardship, Berkshire achieved an impressive 20% compounded annual gain from 1965 to 2024, significantly outperforming the S&P 500.

Saylor's Bold Comparison

Michael Saylor, Strategy Executive Chairman, has boldly stated that Berkshire Hathaway is the Bitcoin of the 20th century. He expressed this sentiment on May 3, coinciding with Berkshire's annual shareholder meeting in Nebraska. Saylor tweeted:

"Berkshire Hathaway is 20th Century Bitcoin."

Buffett, at 94, has led the company for 60 years, making it a $1.1 trillion conglomerate and a hallmark of disciplined, long-term investing.

Diversification and Future Plans

During the shareholder meeting, Buffett hinted at the possibility of diversifying into other currencies, stating that Berkshire avoids holding assets tied to collapsing currencies. He remarked:

"We wouldn’t want to be owning anything that we thought was in a currency that was really going to hell."

Buffett emphasized Berkshire’s opportunistic investment approach, revealing that the company is considering significant deals that could amount to $100 billion under the right conditions.

Bitcoin: A Contradictory Stance

Despite his long-standing criticism of Bitcoin, famously calling it “rat poison squared,” Buffett has indirectly benefitted from the cryptocurrency market through Berkshire's portfolio companies. Since 2015, Bitcoin has outperformed Berkshire Hathaway significantly, delivering over 780% gains since 2020 compared to approximately 150% for Berkshire.

Berkshire holds a substantial stake in Bank of America, which has invested in several spot Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT). Additionally, Berkshire has invested over $1 billion in Nu Holdings, a Brazilian digital bank that offers crypto services, and holds shares in Jefferies Financial Group, which promotes Bitcoin as a hedge against inflation.

At the time of writing, Bitcoin was trading above $96,800, showcasing its resilience in the market.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!