The price of Bitcoin fell below the key support level of $110,000 on Thursday, while spot silver surged past $45 today, reaching a 14-year high. Peter Schiff believes that the 'hoarding' business model is unsustainable, and companies like MSTR are heading towards a 'brutal bear market.' Analysts warn that MSTR must hold its current price level; if the support level breaks, the stock price could further drop to $240.

As the price of Bitcoin continues to decline, the 'Bitcoin-hoarding' strategy of holding large amounts of cryptocurrency as corporate reserves is facing a severe test.

Recently, the cryptocurrency market experienced large-scale liquidation, with Bitcoin prices falling below the key support level of $110,000 on Thursday, and Ethereum breaking through the $3,900 mark. Meanwhile, silver surged significantly, breaking above $45 today and reaching a 14-year high.

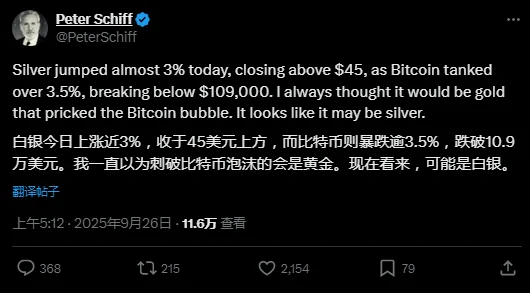

Amid this market turmoil, Peter Schiff, a precious metals dealer and well-known 'Bitcoin critic,' warned on the social media platform X that companies holding Bitcoin as an asset are entering a 'brutal bear market,' raising questions about the viability of their business models.

He expressed uncertainty about whether companies like MicroStrategy (MSTR) can survive the crisis unscathed.

As a staunch gold bull, he also stated, 'I always thought it would be gold that would burst the Bitcoin bubble. But now, it seems it might be silver.'

This statement amplified concerns in the market about the sustainability of the business models of 'Bitcoin-hoarding' companies. Market data shows that MSTR's stock price plummeted significantly in recent trading, falling below the $300 mark for the first time since April of this year, nearly wiping out its year-to-date gains.

MSTR is also referred to as a 'Bitcoin shadow stock' because of its substantial holdings in Bitcoin, with its share price closely linked to the price of Bitcoin. The recent weakness in Bitcoin has directly weighed on its stock performance.

Schiff issued a bear market warning, while MSTR continued to increase its holdings against the market trend.

Prior to this, Schiff had pointed out that although many companies are emulating MSTR founder Michael Saylor's 'imaginative business strategy,' few have noticed the significant decline in MSTR's share price.

Schiff warned at the time that Ethereum was already in a bear market, and Bitcoin would be next.

Despite the drop in share price, Michael Saylor appears to remain steadfast in his Bitcoin accumulation strategy.

It was reported that MSTR purchased an additional 850 Bitcoins last week. Disclosure documents show that MicroStrategy currently holds a total of 639,835 Bitcoins, with a total acquisition cost of $47.33 billion.

Notably, part of the company's recent funding for Bitcoin purchases came from the sale of MSTR’s own shares. In a downward cycle of asset prices, using equity sales to increase positions in highly volatile crypto assets undoubtedly heightens the company's financial risks and raises questions among investors about the robustness of its strategy.

From a technical analysis perspective, the outlook for MSTR's share price is similarly bleak. Analyst Peter DiCarlo noted that after briefly holding support levels, MSTR's share price has shown signs of 'breakdown,' and the rebound anticipated by the market several weeks ago did not materialize.

DiCarlo warned that the current price level must hold; otherwise, MSTR's share price could face 'serious trouble' in the coming months. If support is lost, the share price may further decline to the $240 level.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!