Bitcoin (BTCUSD) is at a pivotal moment as it enters the seventh week of its latest "price discovery uptrend," with analysts warning of a potential correction on the horizon. Historical patterns suggest that Bitcoin's price discovery uptrends typically last between five to seven weeks before a correction phase begins.

Key Insights from Market Analysts

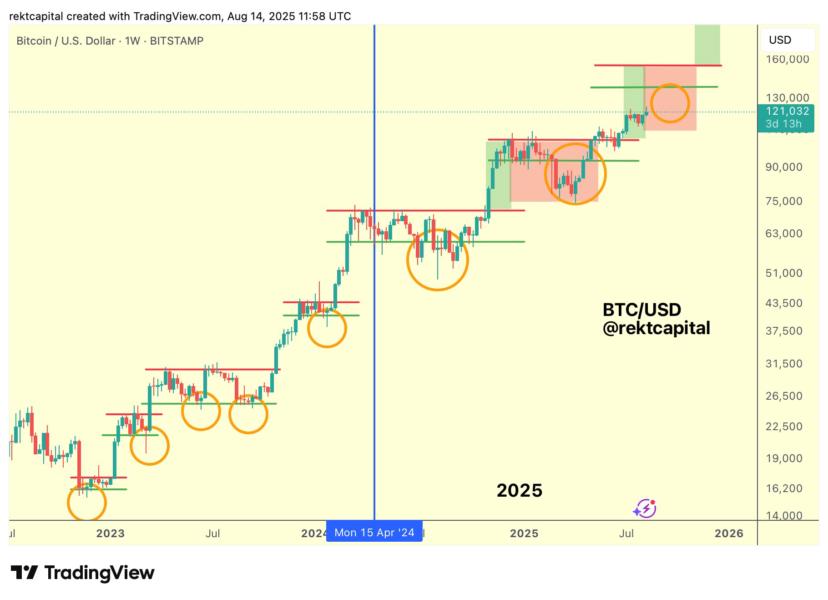

- Rekt Capital, a renowned trader and analyst, highlights that Bitcoin is nearing the end of its second uptrend phase post-2024 halving, based on historical data.

- Previous cycles show that Bitcoin's second uptrend tends to conclude between weeks 5 and 7, with corrections often leading to significant drawdowns, such as the 30% drop observed in 2025.

What This Means for Investors

- A correction now could set the stage for fresh all-time highs in Q4, aligning with historical bull market trends where explosive rallies follow short-term dips.

- Daan Crypto Trades points out that Bitcoin has yet to see back-to-back green months in August and September, suggesting potential volatility ahead.

Market Sentiment and Data

- CoinGlass data indicates Bitcoin is up 2.1% in August, slightly above the historical average, while September typically sees a 3.8% drawdown.

- Analysts remain cautiously optimistic, noting that any significant dips in the coming months could be the last major buying opportunity before a year-end rally.

Disclaimer: This article does not constitute investment advice. Always conduct your own research before making any investment decisions.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!