Historic Low Volatility Indicates a Major Move for Bitcoin

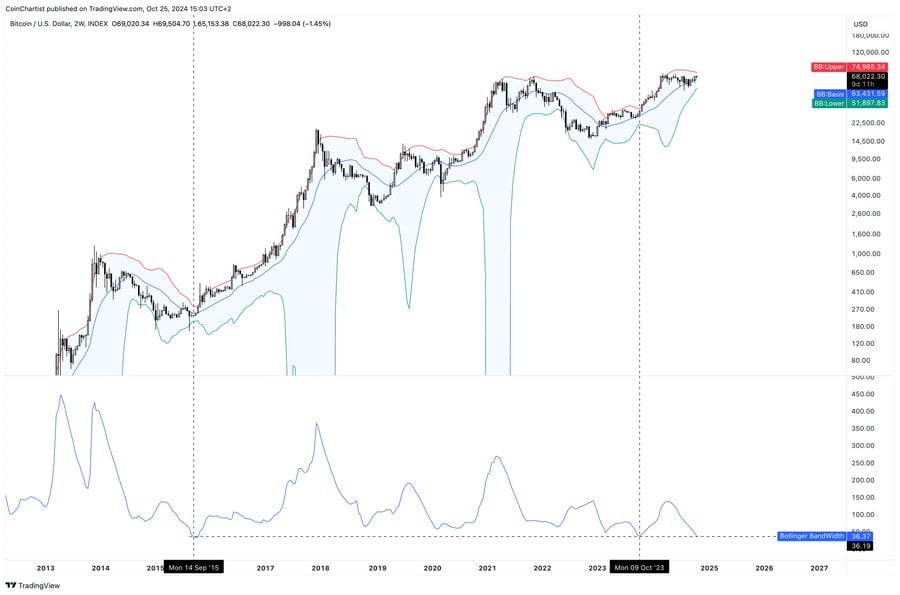

Bitcoin is currently poised for a significant price movement as its Bollinger Bands are exhibiting one of the tightest formations in history. This phenomenon, known as a “Bollinger Squeeze,” reflects a period of low volatility that often precedes a powerful price breakout.

“A huge move is coming,” stated technical analyst Tony Severino. He emphasized that Bitcoin's Bollinger Bands are among the three tightest instances ever observed on a 2-week timeframe.

Author: Tony Severino

Historically, such contractions in Bollinger Bands have led to substantial price changes for Bitcoin. For instance, in April 2016, a similar pattern preceded a dramatic rise in Bitcoin prices, marking the onset of a bullish trend. Another notable instance was in July 2023, when the bands tightened significantly, once again leading to a major price surge.

While tightening bands suggest a potential for a big move, they do not indicate the direction of that move. For example, a similar tightening pattern in 2018 resulted in a sharp decline in Bitcoin’s price. However, historical data shows that Bitcoin has rallied upward after tight band conditions seven out of nine times.

Bitcoin Whales Accumulate Coins at an Unprecedented Rate

Recent reports indicate that Bitcoin whales have amassed 670,000 BTC, marking the highest whale holdings ever recorded. Historically, such significant accumulation has been followed by major price rallies. However, the current sideways trend implies that a major price move may not be imminent. If Bitcoin fails to achieve new highs by late November, it could signal challenges ahead for the ongoing bull cycle.

Recently, Bitcoin dipped below $65,500 amid reports of a criminal investigation into Tether, the world’s largest stablecoin. According to the Wall Street Journal, federal prosecutors are investigating Tether’s potential involvement in facilitating drug trafficking, terrorism financing, and hacking activities. Tether's CEO, Paolo Ardoino, has firmly denied these allegations, labeling them as “unequivocally false.”

Additionally, geopolitical tensions, particularly between Israel and Iran, have contributed to market volatility. On October 26, Israel announced direct strikes against Iran in response to missile attacks. Bitcoin’s price remains sensitive to geopolitical turmoil, often experiencing swift declines followed by recovery phases. As of now, Bitcoin is trading around $66,800, reflecting a 1.3% drop over the last 24 hours according to CoinGecko.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!